1. Introduction

The purpose of this report is to analyse the current marketing strategy of CityRail and recommend possible marketing initiatives for future improvement. CityRail operates the metropolitan train services in Sydney. It is a monopoly with indirect competitors in form of cars, buses and ferries. Despite its unique position and differentiated services it still needs to be heavily subsidised by government as its total costs are far greater than its revenue. CityRail’s performance is mostly criticised for the lack of punctuality, overcrowding, low geographic coverage and poor service quality.

2. Company Background

CityRail is a company providing passenger rail services within the Sydney metropolitan area. CityRail and its sister company CountryLink, which offers transportation services in rural NSW, are run by the State owned public transport provider Rail Corporation NSW (RailCorp, 2007).

While the Sydney railway system started in 1855, CityRail has officially operated on the market since around 1990, after being established under the ‘NSW Transport Administration Act 1988’ (Tracking Trains, 2008).

3. Branding

Benefitting from a monopoly position in the passenger rail transport services sector in Sydney, CityRail has a very high brand recognition and awareness. On the other hand, the perceived quality of CityRail’s services and performance on aspects such as security, punctuality and time of journey (Sydney Morning Herald, 2008), is poor, which negatively influences the brand equity of CityRail (Independent Transport Safety and Reliability Regulator [ITSRR], 2007). Finally, even though CityRail has a high level of brand loyalty among customers, this loyalty is rather ‘circumstantial’ as there is ‘a lack of reasonable alternatives’ (Lehmann & Winer, 2005, p. 242). Overall, the brand equity of CityRail is not strong and should be better managed in order to increase and add more value to both the company and its customers.

When assessing brands and their various attributes as perceived by customers, the concept of ‘brand personality’ can be very useful. The authors of this report suggest the following ‘CityRail personality’ based on their personal experience with and research on CityRail.

|

Male, 55 years old, short, overweight, grey hair, high school education,

below-average income, clerical worker |

|

Living in Redfern |

|

Unreliable, conservative, clumsy, good nature / intentions but poor practical application |

4. Service Offering

CityRail offers customers longer-distance transport services on the electricity and diesel-powered trains using the railway infrastructure in Sydney covering the metropolitan area up to far west Penrith, south Waterfall, east Bondi Junction and north Hornsby. The offered services also include the assistance of CityRail staff with any travel-related problems or enquires passengers should have.

CityRail operates in the category of railway public transport services in Sydney, which is a monopolistic segment of the market.

5. Situation Analysis

5.1 Macro-Environment Analysis

A detailed PEST Analysis examining the Australian / Sydney market in relations to the public transport industry can be found in Appendix 1.

5.2 Micro-environment Analysis

A detailed Porter’s Five Forces Analysis examining the relationships and environments of CityRail and the analysis of Industry Lifecycle can be found in Appendix 2.

5.3 Market Analysis

The market that CityRail operates in can be specified as public transport in Sydney. The size of this market is substantial with access to 4,119,190 people (ABS, 2006), who reside in metropolitan Sydney and need some convenient means to travel across its 1580 square-kilometre area (SydneyCity, 2008). This suggests a great potential for the public transport industry.

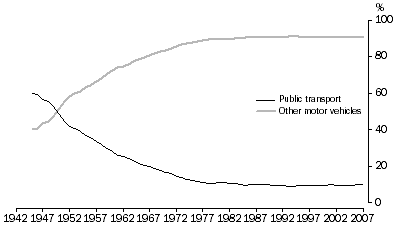

However, the use of public transport decreased rapidly on a per person basis during the 30 years following the World War II. The decline was partially caused by the sharp growth in ownership and use of private cars and since then the use of public transport has remained stable, at only about 10% of total travelled passenger kilometres (ABS, 2008).

On the other hand, the percentage of people using public transport as the main means to travel to work / study in Sydney has increased from 23,4% in 1996 to 26,3% in 2006 (ABS, 2008). This indicates a 12,4% positive change and a good potential for future market growth.

Proportion of Travelled Passenger-Kilometre (1942-2007) (ABS, 2008)

5.4 Performance analysis

5.4.1 Profitability

Based on the data and analysis in Appendix 3, it can be concluded that CityRail’s financial situation is very poor. However, as CityRail provides positive external benefits such as reduced environmental impact and a low cost option of commuting for low-income members of the public it is appropriate for CityRail to be funded by government (Royal Automobile Club of Victoria, 2006).

Also, further information on the Shareholder Value and Customer Satisfaction can be found in the Appendix 3.

5.5 Customer Analysis

As CityRail operates in the ‘public transport’ sector of passenger transportation services in Sydney, its customers comprise the whole general public and community of Sydney. Therefore, based on the nature of public transport, CityRail services are offered to and targeted at all the Sydney-wide population including tourists and visitors.

5.5.1 Current Customers

From the analysis of current customers of CityRail, as performed in Appendix 4, it can be concluded that the market for CityRail consists of all Sydneysiders, who seek the convenience of commuting and transport, independently of most of their other characteristics and current circumstances.

5.5.2 Potential Customers

In order to grow in the future, CityRail does not only aim to satisfy their current customers, but also focuses on the potential customers that are currently non-users of CityRail’s services. The main group of such potential customers can be described as middle-aged people using private cars / buses to travel around Sydney for the following reasons: 42% have a car or other convenient transport available, 24% only have a short distance to work / sport / entertainment, with 13% trains do not go to desired destination, while another 13% perceive that CityRail has some unpleasant aspects etc. (ITSRR, 2008). This and other segments of potential customers should be closely monitored and researched by CityRail so they can be tapped as a market in the future.

Further information on researching customers and their buying behaviour can be found in

Appendix 4.

5.6 Competitor Analysis

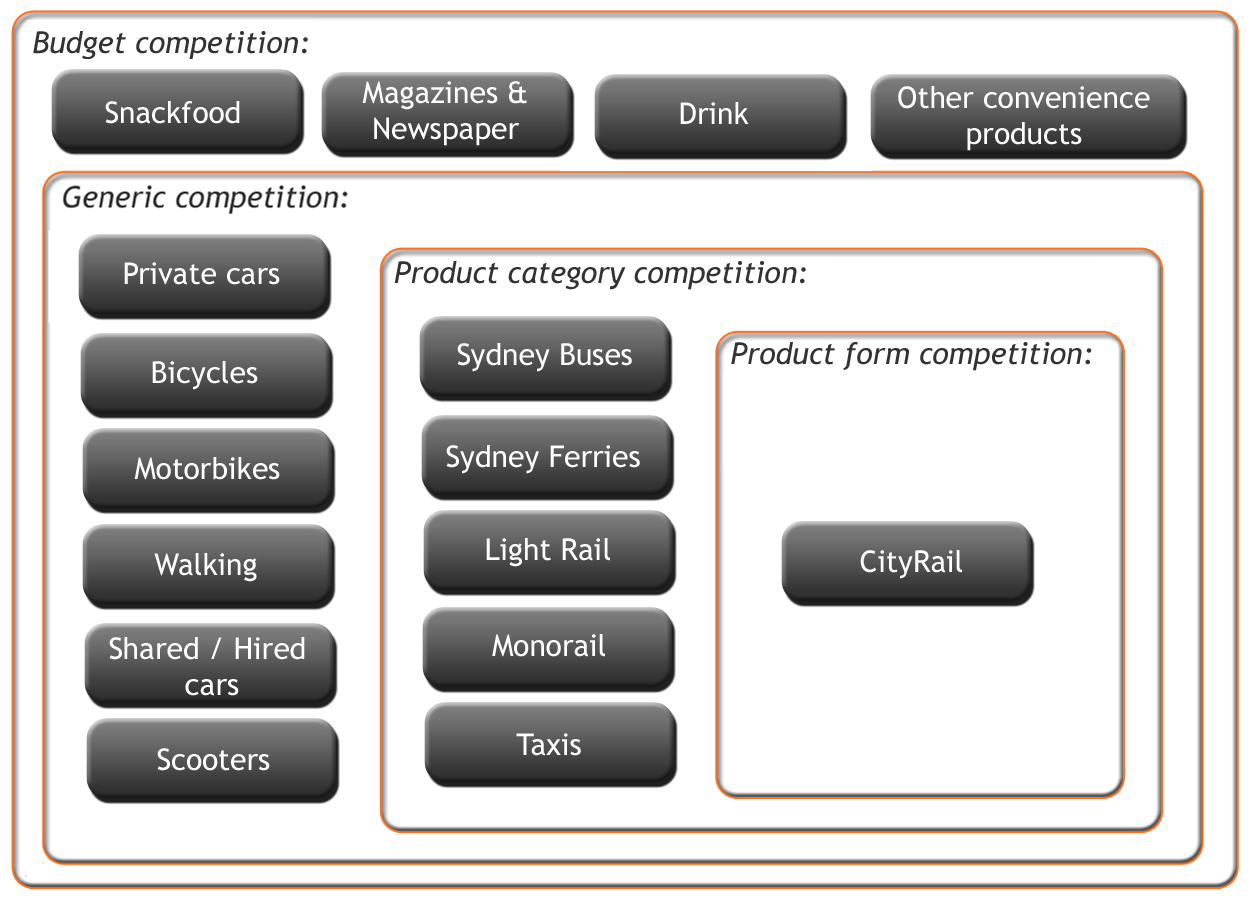

CityRail operates in railway public transport services in Sydney and in this category it has no direct competitor. However, there are several indirect competitors and substitutes for public transport. The major competition for CityRail is Sydney Buses, Sydney Ferries and private cars. Competitor analysis will be based on four levels of market competition and only the Sydney metropolitan area will be considered:

The Four Levels of Competition for CityRail

5.6.1. Product Form Competition (railway public transport)

There is no direct competitor with the same product form. The only competitor, who uses railways for transport, is Light Rail, however it does not share the same rails with CityRail, does not use trains, and has a very limited coverage area.

5.6.2 Product Category Competition (public transport)

The main competitor for CityRail is Sydney Buses which operates public buses in the whole Sydney metropolitan area. Other indirect competitors are ferries (run by Sydney Ferries), monorail and trams, however all of them are geographically limited in that they provide public transport only in certain areas. Also taxis are regarded to be a product category competition as taxis are considered to be part of public transport by the NSW Ministry of Transport (Ministry of Transport, 2007). Taxis are a very attractive alternative which offers personalized service, comfort, speed. However the price per journey is much higher compared to buses or trains (CityRail, 2007). Further information on the product category competition can be found in Appendix 5.

5.6.3 Generic Competition (transport)

In the general transport of persons category there are cars (including hire cars, private cars, borrowed cars, car-sharing companies), motorbikes, scooters and self-propelled ways of transport such as bicycles, roller-skates, walking and other. The most preferred way of travelling in this generic category that threatens CityRail the most is private cars. According to an AAMI 2008 survey, cars are the preferred choice of travelling to school or work - 60% of commuters (Car Central, 2008). Except for walking, every other way of transport requires certain initial costs (highest with cars, lowest with roller-skates), walking is also by far the cheapest alternative, however very slow and inconvenient.

5.6.4 Budget Competition (4$)

A single ticket for an adult commuter costs on average around $4 (CityRail, 2007), therefore in the budget competition category anything that could be bought for such a price is considered a potential competitor. Products such as magazines, newspapers, snack food, coffee and other drinks and various other convenience products compete for those $4.

5.7 SWOT Analysis

| |

Favourable Nature |

Unfavourable Nature |

| |

STRENGTHS |

WEAKNESSES |

| Internal Factors |

- Financial support from the government

- Reasonable pricing

- Joint ticketing structure with Sydney buses and ferries (discount passes)

- Environmental friendliness

- Fast and convenient transport (no need for waiting at traffic lights or parking in the city)

- Comfortable travelling (no need to focus on driving- passengers can read, chat with friends)

- Monopoly in the market (no direct competition)

- Independence of road traffic conditions

- Relative reliability

|

- Safety issues

- Old infrastructure

- Poor customer service

- Poor customer satisfaction levels

- Poor brand image

- Inefficient time management (frequent delays)

- Insufficient number or ineffective management of services and carriages (frequent overcrowding)

- Insufficiently optimised fare and ticketing systems (frequent queues for tickets and passes)

- Bad condition of the rail fleet (not clean: graffiti, rubbish, often lack of air-conditioning)

- Every change requires extensive financial investment

- Low geographical coverage

|

| |

OPPORTUNITIES |

THREATS |

| External Factors |

- Privatisation

- Upgrade of infrastructure and rail fleet

- Expansion in geographical coverage

- Implementation of electronic ticketing (purchasing via mobile or other technology)

- Image and customer satisfaction improvement

- High potential to grow (driven by new technologies, rising petrol prices, increasing population and pressure/trend to use socially and environmentally acceptable public transport)

- Increase in staff productivity and the level of customer service provided to customers

- R&D and innovation in technologies

|

- New market trends (e.g. working from home)

- Privatisation

- Security threats (terrorist attacks / accidents)

- Strengthening indirect competition and development of new substitute services/products

|

6. Marketing Strategy

6.1 Overall Strategy

The whole strategy of CityRail originates from its mission and vision. The mission captures the essence of the CityRail business as a provider of ‘passenger rail service covering the greater Sydney region’ (CityRail, 2008). CityRail’s vision shapes the future aims and effort to ‘deliver safe, clean and reliable passenger services that are efficient, sustainable and to the satisfaction of our customers’ (RailCorp, 2007).

The main objective of CityRail is to ‘build on the success of last year and to continuously improve the safe delivery of train services’ (RailCorp, 2007). CityRail is planning to achieve this while respecting their values of safety, customer service, teamwork, integrity, respect and continuous improvement (RailCorp, 2007).

6.2 Product Strategy Alternative

The authors of this report analysed CityRail’s broad strategic alternative as one based principally on growth. The company’s focus is on long-term objectives and sustainable development.

Some of the main goals of CityRail include: improvement of customer service, increased trains’ capacity to meet greater demand, improvement in efficiency and productivity and continuous improvement of passenger safety and service reliability (RailCorp, 2007). Also, according to the CEO of RailCorp, a ‘key priority for RailCorp … is to increase the number of people using public transport’ in response to the forecasts predicting future rapid growth in Sydney’s population (RailCorp, 2007). Based on these facts, it can be argued that CityRail pursues a combination of market penetration and market development strategies.

With market penetration, CityRail tries to grow its market share through continuous improvement and subsequent promotion of its services (e.g. better time efficiency and increase in on-time running trains and their subsequent promotion to consumers aims to increase usage of CityRail’s services by current customers). Further, with market development CityRail aims to grow its customer base through attracting non-customers, who currently use other transport modes. Also, CityRail looks at expanding its geographical coverage through development of new links.

6.3 Product Differentiation

CityRail essentially utilises in a focused differentiation strategy. It offers its services to a specific group of customers limited to the Sydney geographical region. What is more, CityRail’s services are unique in their ability to offer convenience, speed, reasonable pricing and reliability quite independent of road traffic conditions. They are also marketed and positioned as a high performance based service rather than simply as a low-cost cheapest service. These arguments support the limited customer group and differentiated product characteristic features of the focused differentiation strategy.

6.4 Competitive Advantage

CityRail possesses a unique distinctive competency in the nature of its service- it is the convenience of passenger RAIL transport within the Sydney metropolitan area. Built around this distinctive competency is the differentiation of CityRail’s services over its indirect competitors, creating a strong competitive advantage for CityRail.

6.5 Marketing Mix

A detailed outline of the seven marketing P’s of CityRail’s current marketing strategy is provided in Appendix 6.

6.6 Strategy Evaluation

Based on the provided description and analysis, the authors of this report consider CityRail’s current marketing strategy to be appropriate. However, it lacks an important feature of customer focus. The position and performance of CityRail rather reflects its appointed requisite role of providing transportation services to the general public. Consequently, CityRail’s marketing strategy is not customer-driven and market-oriented enough.

The authors of this report believe that CityRail does not recognise its important role of providing quality transportation to the people of Sydney based on their preferences, needs and requirements. This in turn has a negative effect on CityRail’s marketing strategy and its implementation, as they are overly product-focused and government-dependent. 7. Recommendations

The following recommendations for future improvements and strategy of CityRail are grouped according to the Seven P’s of services marketing and are based on the need for an increased focus on customers, their values and wants. In general, CityRail should aim to improve its services, engage in geographical expansion and improve its brand equity.

PRODUCT: Upgrade of Trains and Stations

- New modern trains with enhanced security features

- Inbuilt notebook and mobile phones chargers (Daily Telegraph, 2008b)

- Free wireless Internet (Wi-Fi), TV or other onboard entertainment- e.g. one screen per carriage

- New carriages with foldable seats for standing in peak times and sitting off-peak

• PRICE: Integrated Pricing and Fare System

- Implementation of a new integrated public transport system – optimisation through integrating all public transport systems in Sydney (trains, buses, ferries) with a unified fare system. Based on this, the new tickets would be time-limited (instead of distance limited) and would offer unlimited change of public transport modes on one ticket (SPUTNIC, 2008).

- Buying tickets via SMS or Internet

• PLACE: Geographical Expansion

- Developing new lines and stations in order to improve CityRail’s geographical market coverage

- Property development in areas surrounding stations- e.g. parking facilities, supermarkets

• PROMOTION: Integrated Marketing Communications

- Communication campaigns highlighting improved quality and various reasons for using train

- Advertisements on trains and at stations

- Wall projectors with up-to-date news and ads in stations

- Vending machines for food (that doesn’t cause dirt and rubbish in trains) and magazines

• PEOPLE: Better Focus On Customer Service

- Regular quality training of train crew and station staff to increase the level of customer service

- More frequent patrols and monitoring of train interiors

• PROCESS: Improvement in Efficiency

- Punctuality and on time train running

- Better synchronisation of timetables for various trains

- Running more trains more often (more than once in every 10 minutes during peak times)

- Research and analysis of customers could lead to higher personalisation of train services (in pricing options or regular journey routes)

• PHYSICAL EVIDENCE: Pleasant Travelling on Trains

- Use music and other pleasant interior features in trains

- Dramatically increase penalties for damaging or polluting trains (graffiti, rubbish, etc) 8. Conclusion

CityRail is a government run company operating railway public transport in the Sydney metropolitan area. Although it is a monopoly, it does not act in the same way as some private monopoly companies, as it is a public service which generates positive externalities such as reducing air pollution, relief for congested roads and cheap and convenient means of travelling. Its marketing strategy aims to gain more customers, preferably from former car drivers, and improve services for current customers. However the main obstacle CityRail is facing is not the strategy itself but its poor implementation. The authors of this report suggest a new updated strategy with greater focus on customers and proposed some improvements to help CityRail achieve its goals. |